I - VC is Inefficient

Venture capital doesn’t work the way people think. Outsized returns come from a tiny number of companies — but those allocations almost always go to the same insiders. Most funds chase the same deals, at the same time, at inflated valuations, which is why the majority of VC underperforms the S&P 500.

VC is not just about picking. It’s about unique access, differentiated insight, and speed.

The firms that win secure allocation in elite companies before the broader market — leveraging proprietary relationships, informed conviction, and decisive execution — gaining access to off-market opportunities traditional funds cannot access.

II - VC Stopped Funding the Future

Instead of funding new technology, VC began backing companies that make small improvements to existing products or focus on marketing, pricing, and growth tactics. These businesses rarely create durable value, which is why returns have been poor.

Markets consistently reward companies that solve hard technological problems.

Investment Strategy

We back companies pursuing hard technological breakthroughs — the kind that solve fundamental problems in AI, robotics, energy, and space, and that create category-defining outcomes in enormous markets. Our focus is on real technology, not incremental features. We invest where deep engineering, complexity, and non-consensus insight produce outsized power-law returns.

While we participate in select primary rounds, we prioritize secondary allocations where pricing is more attractive, allowing us to enter high-quality companies at meaningful discounts.

Investing in Category-Defining Companies

Edge

Our edge comes from access and speed. Through our global network of VCs and founders, we source opportunities before they hit the open market. We build relationships directly with insiders looking for liquidity, giving us access that most investors never see. We move faster than institutional funds, often closing investments within 30 days. This speed and reliability make us a preferred counterparty for sellers.

Access & Speed

Investment Criteria

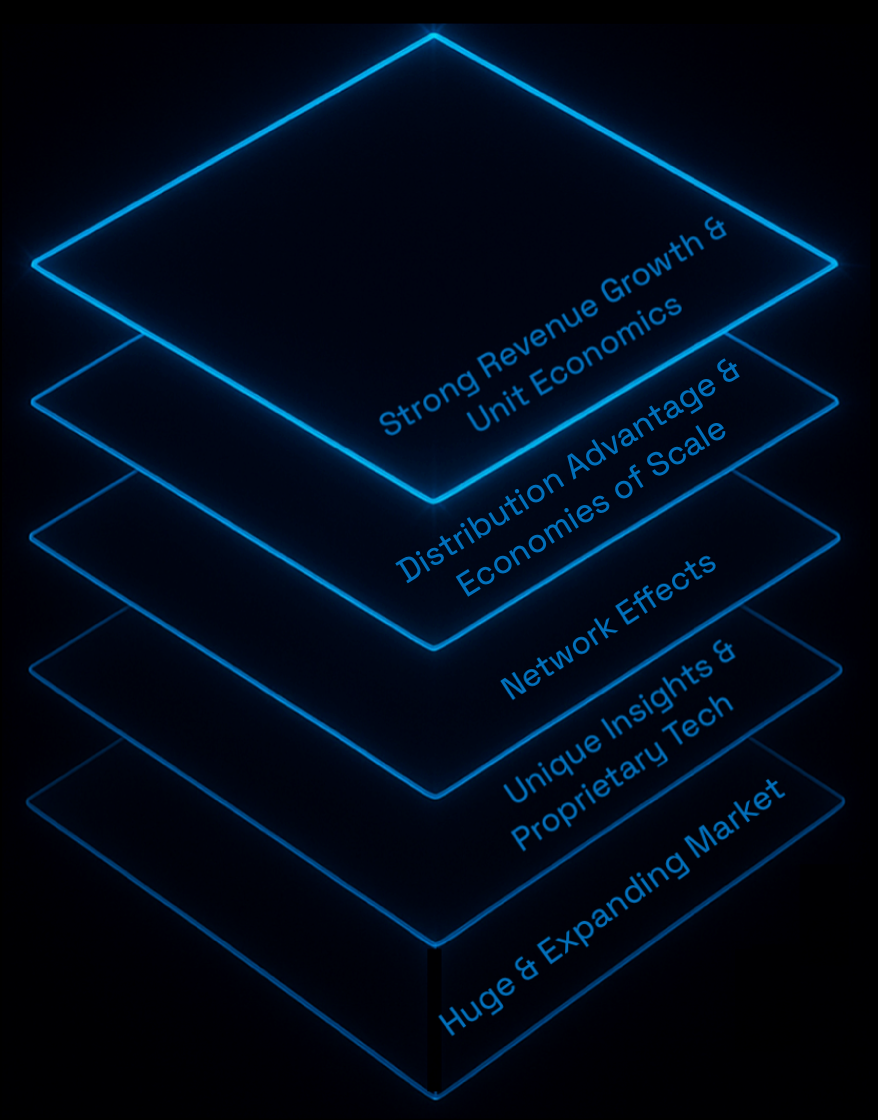

At V11, we invest in companies operating in massive, expanding markets with unique insights and proprietary technology at their core. We look for products that generate network effects, whether through people, usage, or data - creating compounding value as the ecosystem grows. As these companies scale, distribution advantages and economies of scale drive down marginal costs and accelerate efficiency. Over time, this foundation translates into superior unit economics, strong revenue growth, and the emergence of a trusted brand that reinforces awareness, loyalty, and long-term defensibility.

“Every monopoly is unique, but they usually share some combination of proprietary technology, network effects, economies of scale, and branding."

- Peter Thiel

Market Analysis & Opportunity

AI adoption is accelerating across every industry as enterprises move from experimentation to full operational deployment. Falling compute costs, rapid model efficiency gains, and the rise of AI agents are transforming workflows, automating decision-making, and unlocking new productivity levels. With organizations integrating AI into core business functions, demand is compounding and creating one of the largest technology waves of the decade.

AI

Robotics and autonomous drones are entering a breakout phase as hardware costs fall, sensors improve, and AI enables real-time perception and decision-making. Enterprises are rapidly deploying delivery drones, warehouse robots, and early humanoids to reduce labor shortages and improve efficiency. With global infrastructure and logistics companies scaling adoption, the category is moving from pilots to full commercial rollout, creating one of the strongest long-term growth curves in modern technology.

Robotics

The global energy sector is being reshaped by the explosive demand for AI compute, electrification, and next-generation infrastructure. Data centers, EV fleets, and industrial automation are driving massive new loads that legacy grids cannot support. This shift is accelerating investment into renewables, long-duration storage, small modular reactors, and early fusion technologies. As the world races to build the energy backbone for the AI era, the category is entering its largest growth cycle in decades.

Energy

Space technology is accelerating as launch costs continue to fall, satellite constellations scale globally, and commercial players take over missions once reserved for governments. New capabilities in Earth observation, communications, in-orbit manufacturing, and microgravity research are opening multi-billion-dollar markets. With defense, climate monitoring, logistics, and AI all relying on space-based infrastructure, the sector is entering a long expansion cycle driven by commercial demand and national security priorities.

Space Tech

“Our civilization is built on technology. Technology is the spearhead of progress, the realization of our potential.” - Marc Andreessen

From Frontier to Scale – Backing Defensible AI & Frontier Tech

From Frontier to Scale – Backing Defensible AI & Frontier Tech

Where We Invest

-

Defensible, sector-specific AI platforms that build moats through proprietary data, regulatory depth, and workflow integration.

-

Humanoid Robots; Delivery Drones;

-

AI-driven grid optimization; Energy Storage solutions; Nuclear Fusion.

-

Orbital analytics, autonomous spacecraft, and frontier launch systems shaping the future of civilization.

How We Invest

-

Series A-C ; Secondaries

-

United States

-

$250K - $2M