At V11, we believe venture capital is evolving. What started as strategic investing is now enhanced by technology and will soon be driven by AI and data. Our model progresses through three phases — investing with insight, augmenting decisions with AI, and building an automated, human-led VC platform.

Evolution Timeline: From Insight to Infrastructure

-

Invest in Series A–C startups with strong traction

Focus on GTM, revenue, and operational strength

Begin capturing data on founders, rounds, and performance

Vexter starts logging foundational data

-

Centralize and structure deal data

Enrich each opportunity with founder, traction, and sector signals

Build scoring systems to rank and qualify companies

Vexter uses this enriched data to train machine learning models that spot patterns in successful deals

-

Vexter powers sourcing and investment decisions

Surfaces high-potential startups using real-time behavioral and digital signals

Scores founders and teams based on historical success indicators

Enables fast, data-driven decisions across sourcing, check sizing, and follow-on

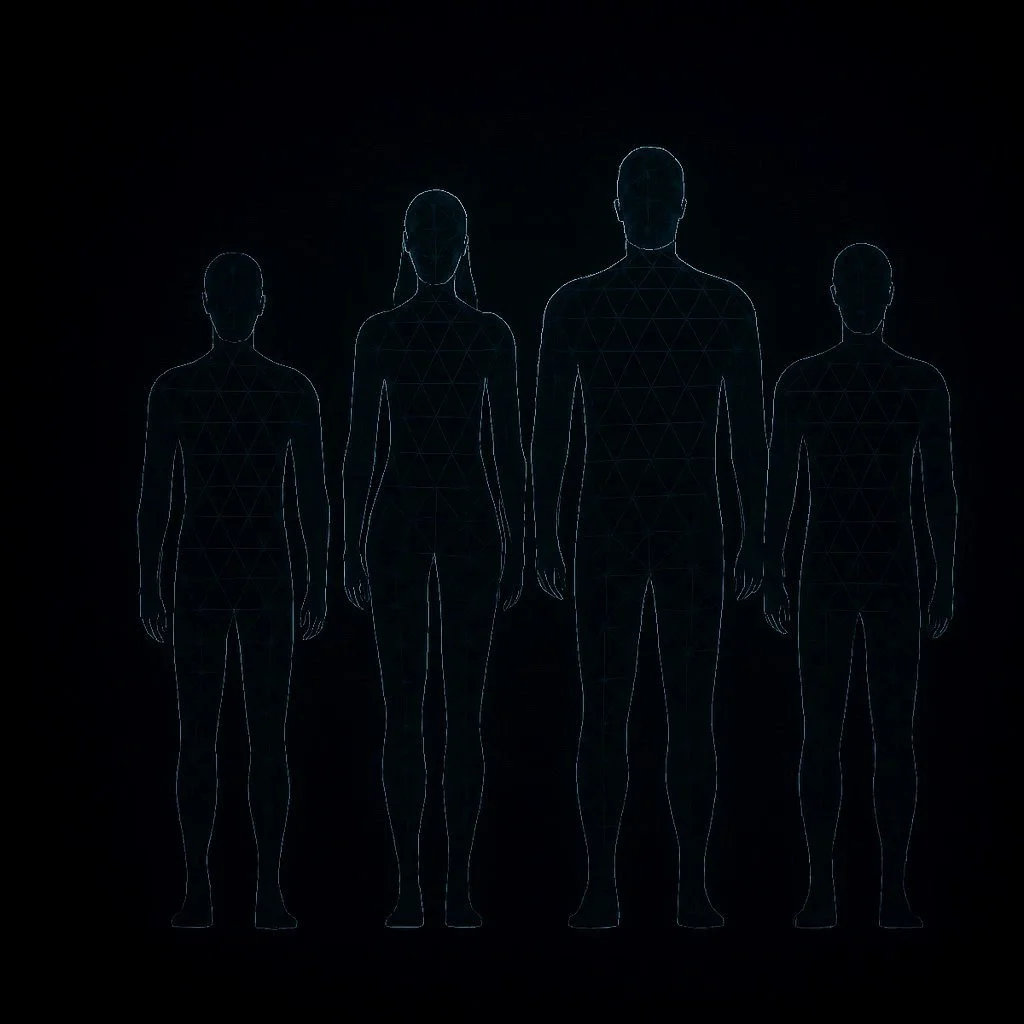

V11 is developing a machine-learning platform to understand what makes the best founders and teams scale. The Founder & Team DNA Engine goes beyond pitch decks to analyze real behavioral signals.

We’re identifying traits that drive founder success — follow-through, resilience under pressure, and clear communication. Using AI, Vexter extracts and validates these signals from sources like LinkedIn, X, and email activity against real outcomes such as fundraising and execution.

Founder & Team DNA Model

Vexter will track how teams evolve — becoming more structured, improving communication, and strengthening stability — learning which teams adapt and outperform over time.

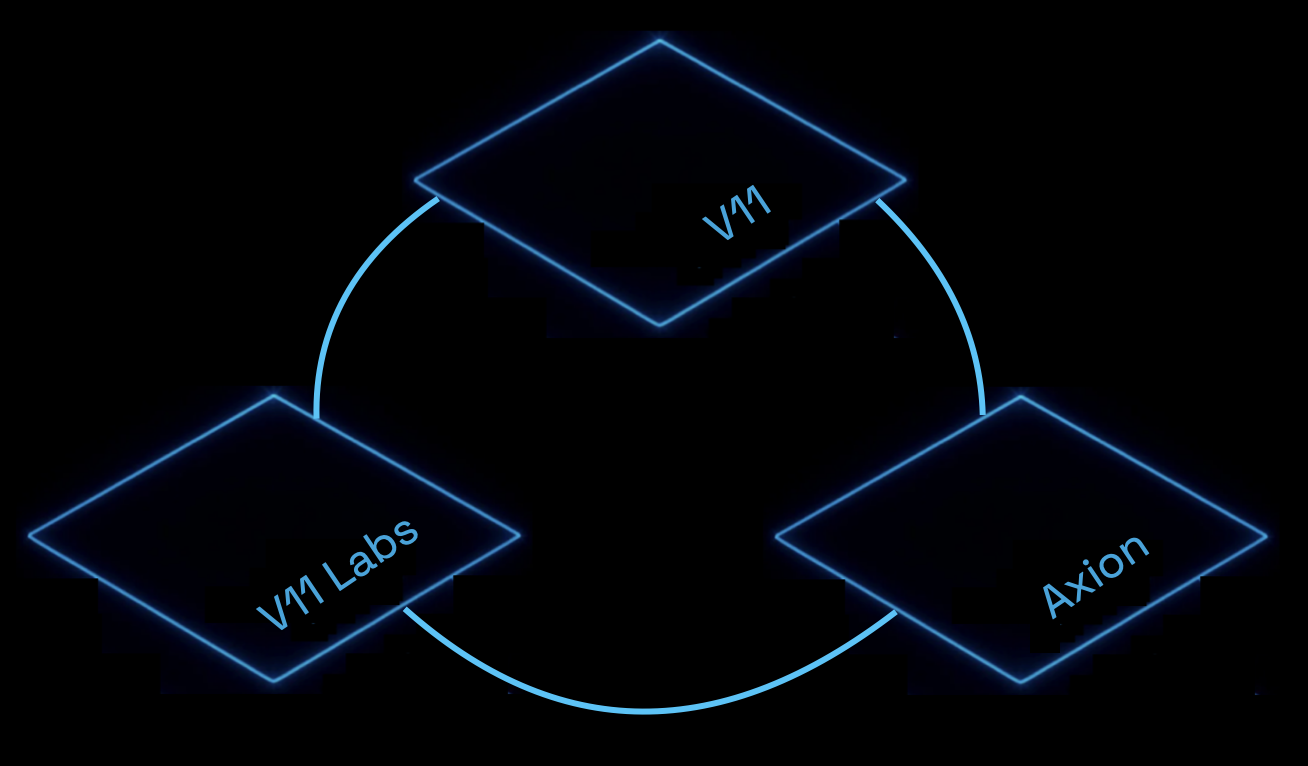

The V11 Flywheel

At V11, everything is connected — our Axion founders, Labs, and the investment arm all reinforce each other.

-

Labs gives selected Axion startups enterprise access and pilots → startups provide innovation that can plug into Labs’ ecosystem.

-

Validated startups from Axion feed into V11’s pipeline → V11 invests in them and helps scale.

-

By using the startups’ products ourselves, we see real client reactions and team execution before investing - giving us conviction built on proof, not pitch.

This creates a self-reinforcing loop: Each cycle compounds, making the ecosystem smarter, faster, and more defensible.

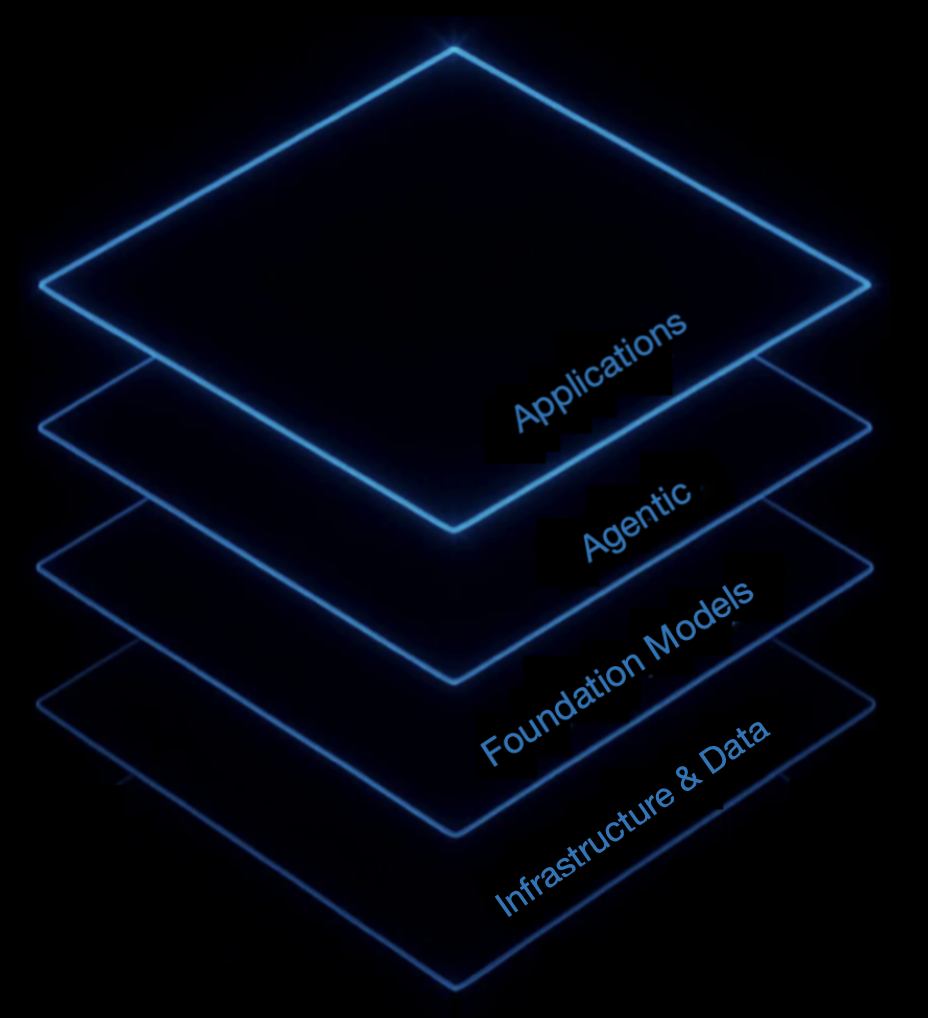

How We Map the AI Ecosystem

-

The backbone of AI — chips (NVIDIA, AMD, Intel), cloud (AWS, GCP, Azure), and data platforms (Snowflake, Pinecone, MongoDB) that provide the compute and storage needed to train and deploy models.

-

Large general-purpose models trained on massive datasets — LLMs (OpenAI, Anthropic, Mistral), multimodal models (Gemini, Claude), and open-source alternatives (LLaMA, Falcon).

-

The orchestration and reasoning layer that allows models to act, plan, and execute across workflows. Includes frameworks (LangChain, LlamaIndex), fine-tuning platforms, autonomous agents, and tool-use capabilities.

-

User-facing products that turn intelligence into solutions. Can be horizontal (Notion AI, Copilot, perplexity) or vertical (AI in healthcare, fintech, legal, robotics).

Investment Strategy

At V11, we focus on the places where technology creates lasting impact. We back Vertical AI platforms that don’t just plug into industries — they become the backbone of workflows, learning from usage, compounding data advantages, and building defensibility as they scale.

“Every monopoly is unique, but they usually share some combination of proprietary technology, network effects, economies of scale, and branding." - Peter Thiel

“Our civilization is built on technology. Technology is the spearhead of progress, the realization of our potential.” - Marc Andreessen

Alongside AI, we invest in Frontier Technologies — the sectors where progress in the physical world redefines what’s possible. From breakthroughs in healthcare and biotechnology, to orbital launch and space infrastructure, to the reinvention of energy and industrial systems through robotics, these are the pillars that will shape the next chapter of civilization.

From Frontier to Scale – Backing Defensible AI & Frontier Tech

From Frontier to Scale – Backing Defensible AI & Frontier Tech

Where We Invest

-

Defensible, sector-specific AI platforms that build moats through proprietary data, regulatory depth, and workflow integration.

-

AI-driven grid optimization, carbon intelligence, and next-generation energy infrastructure.

-

Clinical AI, biotech discovery engines, and digital health platforms transforming patient care.

-

Orbital analytics, autonomous spacecraft, and frontier launch systems shaping the future of civilization.

How We Invest

-

Series A-C

-

United States

-

$500K - $5M